tax avoidance vs tax evasion philippines

Some luminaries have 3 categories instead of 2. Tax Avoidance Vs Tax Evasion Philippines.

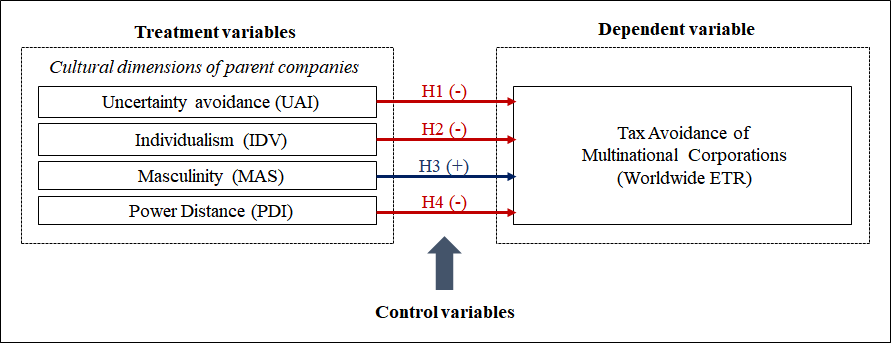

Sustainability Free Full Text National Culture And Tax Avoidance Of Multinational Corporations Html

This is generally accomplished by claiming.

. Tax evasion is the use of illegal means to avoid paying your taxes. Tax avoidance is organizing your undertakings with the goal. Tax Evasion vs.

Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced. So above I started off talking about Tax Evasion vs Tax Avoidance. Tax July 1 2022 arnold.

This is entirely different from tax evasion which is. Tax Avoidance Vs Tax Evasion Philippines. Tax avoidance and tax evasion are different methods people use to lower taxes.

Tax avoidance is the use of tax-saving. Tax evasion occurs when the taxpayer either evades assessment or evades payment. By Euney Marie Mata-Perez on November 18 2021.

This is entirely different from tax evasion which is. Usually tax evasion involves hiding or misrepresenting income. The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge.

To start with tax. Key Differences in Evasion Vs Avoidance. Tax July 1 2022 arnold.

Tax avoidance vs tax evasion 2021-11-18 - MORE TO FOLLOW MTF EUNEY MARIE MATA-PEREZ. Delaying or postponing the sale of a. Tax Avoidance Vs Tax Evasion Philippines.

Tax Avoidance Vs Tax Evasion Philippines. There are currently 31 Philippine tax. Tax evasion on the other hand is using illegal means to avoid paying taxes.

Lord Templemans article in a 2001 Law Quarterly Review called Tax. Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed. The difference between tax evasion vs tax avoidance is tax evasion is illegal while tax avoidance is unethical.

In tax avoidance you structure your affairs. The Philippines has concluded several tax treaties to avoid double taxation and prevent tax evasion with respect to taxes on income. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax avoidance aka tax minimization is a way taxpayers minimize their taxes through legally permissible means meaning it is not punishable by law. Dont know san yung.

The distinction between tax evasion and tax avoidance to a great extent comes down to two components.

Irs Goes Undercover And The Movement Against Corp Tax Avoidance Htj Tax

Tax Evasion In The United States Wikipedia

Tax Perjury David Klasing Tax Law

Philippine Taxation Evasion Or Avoidance Steemit

Ask The Tax Whiz What Are The Consequences Of Evading Taxes

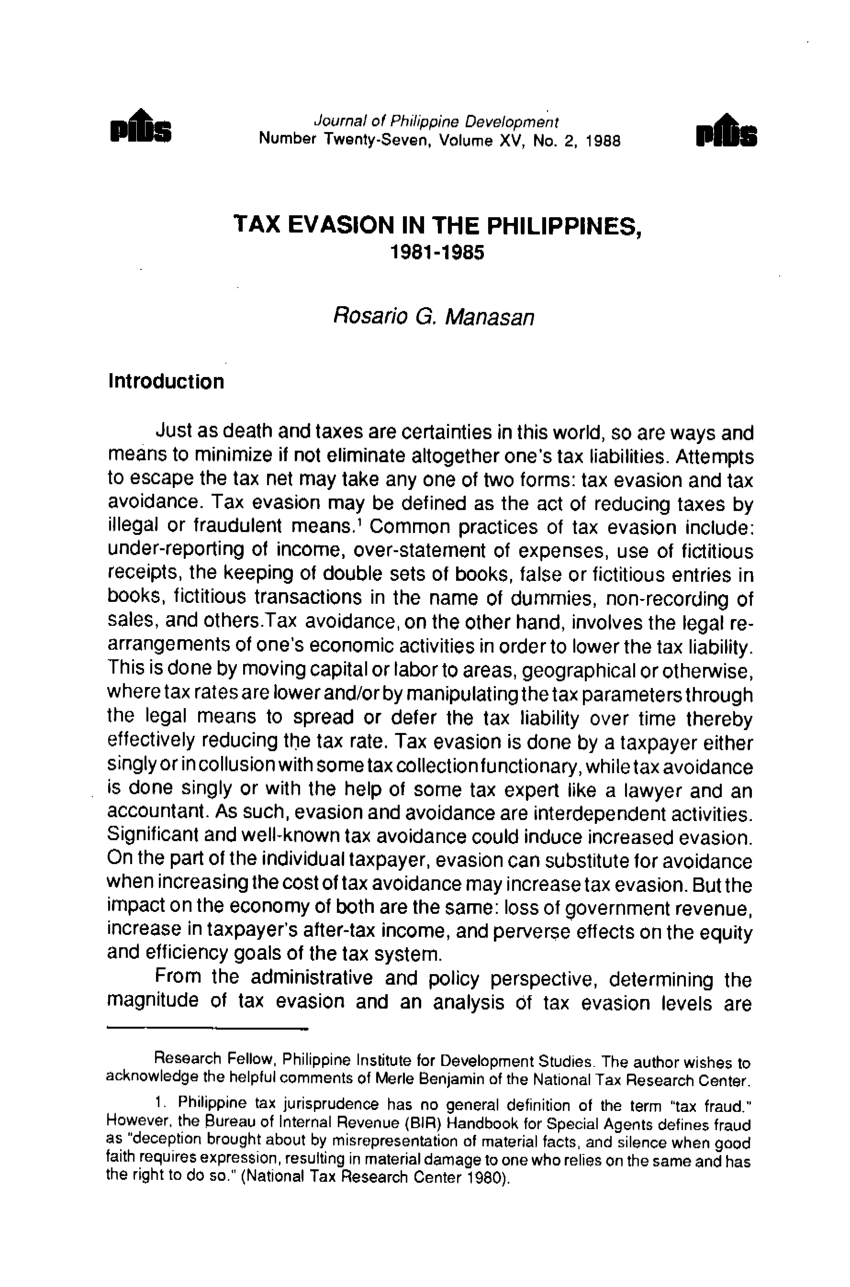

Pdf Tax Evasion In The Philippines 1981 1985

Tax Avoidance Is Legal Tax Evasion Is Criminal Wolters Kluwer

Differentiating Tax Evasion Tax Avoidance

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Tax Morale And International Tax Evasion Sciencedirect

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

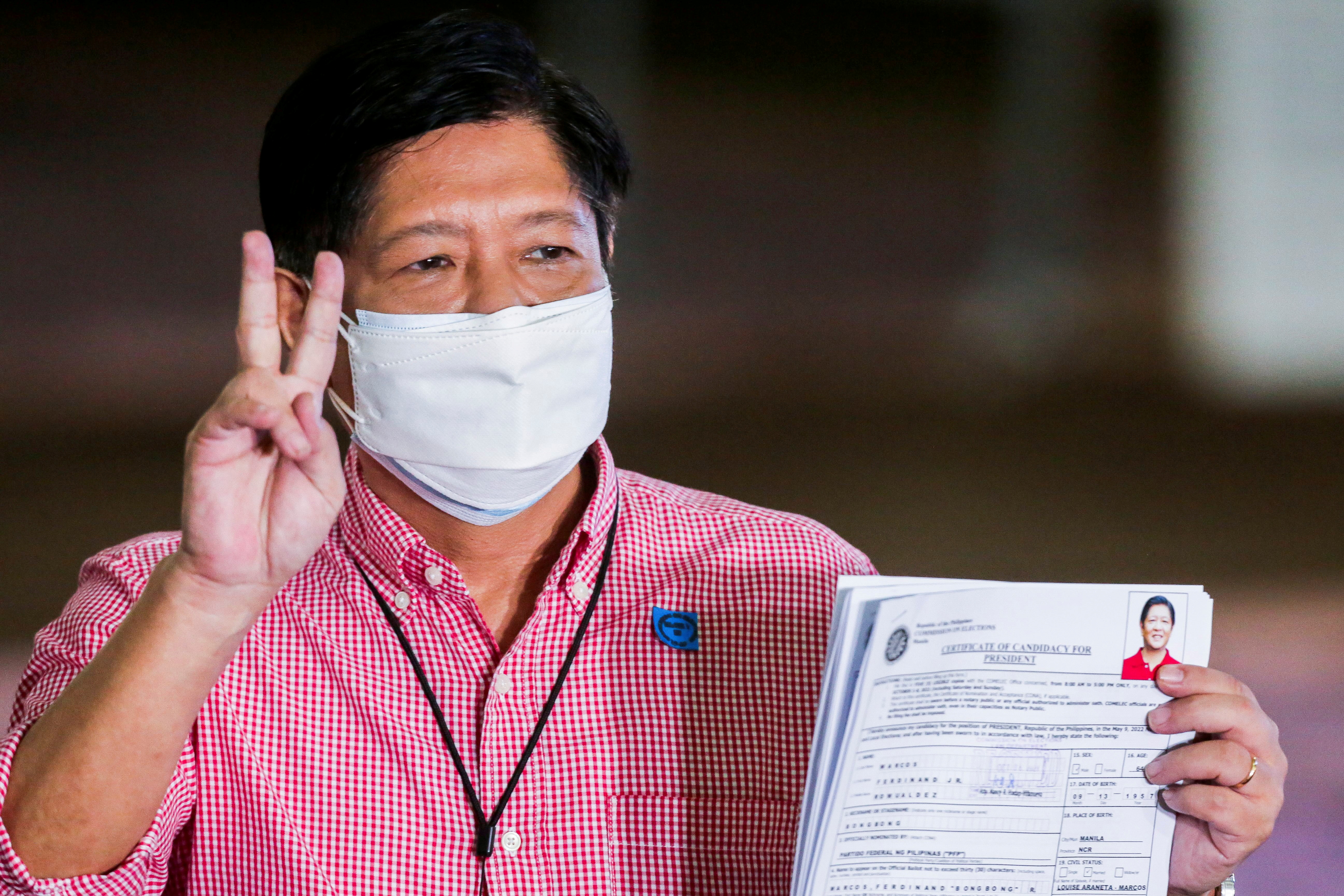

Philippines Group Seeks To Bar Marcos From Presidency Over Tax Evasion Reuters

Tax Avoidance Vs Tax Evasion What S The Difference Informi

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Concept Of Tax Evasion Tax Avoidance Definition And Differences

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion V Tax Avoidance Is There A Difference Pace International Law Review

The Complex Trust Is Simply The Criminal Tax Evasion Device Known As The Pure Trust Repackaged